Final Project Part IIB:

Stamp Prices

by

Jenny Johnson

We can use a data set that includes the prices of US

stamps from 1933 to 2008 to explore the uses of spreadsheets, the idea behind

building lines and other models of best fit, and to use scatterplots to make

predictions about prices in the future.

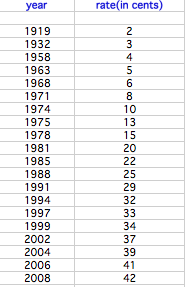

Below is a picture of a spreadsheet in Excel that includes stamp prices

for a 75-year period.

Clearly, the prices have steadily increased, but

have they followed a linear trend? A logarithmic trend? A cubic trend?

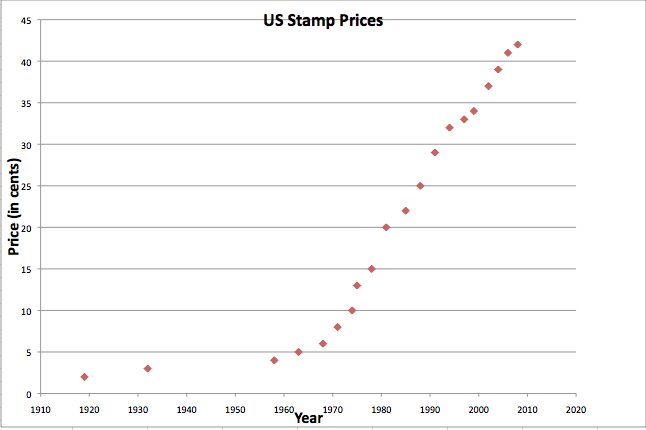

We can find which model predicts our information

best by constructing a scatterplot in Excel.

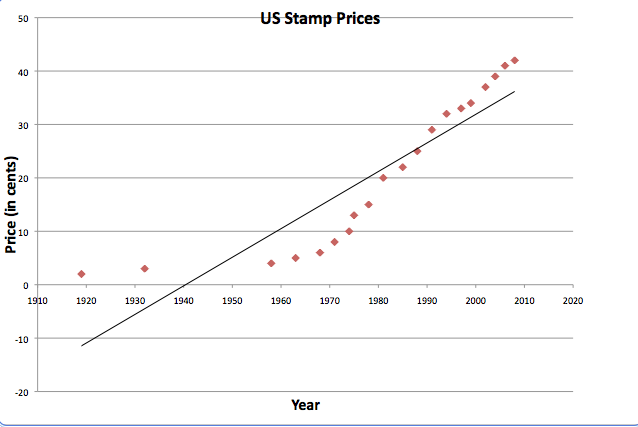

First, we will construct a line of best fit to see

how closely the data fits a linear model.

The line of best fit over-predicts the values of the

stamps from 1960 to 1990 and under-predicts the stamp values from 1990 to

2010. Let us try constructing a

quadratic graph to see if it predicts the values more accurately than the

linear model. The r2 is .8071 which means the variables are quite strongly

linearly associated.

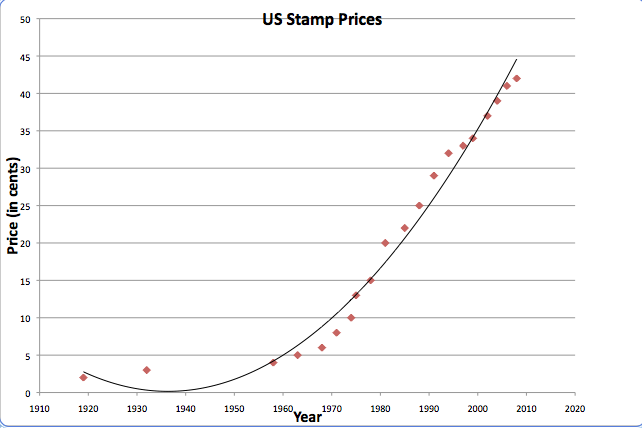

The quadratic model fits the data better than the linear

model. The graph still

over-predicts the price of stamps from 1960 to 1980 and under-predicts the

values from 1980 to 2000, but the residuals are not as large as in the linear

model. The r2 is 9815, which means the quadratic model is a very

good predictor of the price of stamps, even more than the linear model.

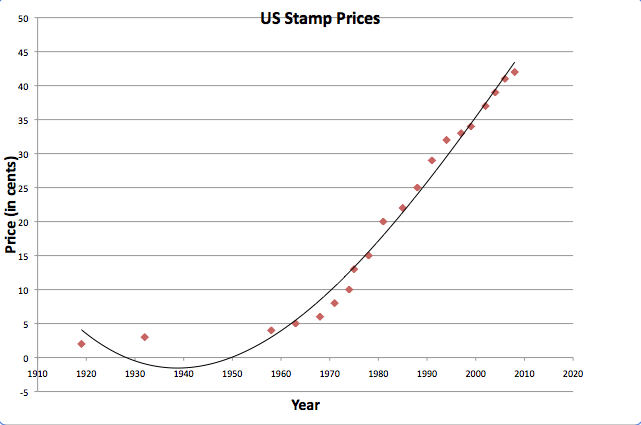

Now let us construct a cubic model for the data.

The cubic model seems to predict the price of stamps

the most accurately of the three models we have tried. The r2 value for the cubic

model is .98428 so this is a good predictor and it is a more accurate predictor

of price than the quadratic model.

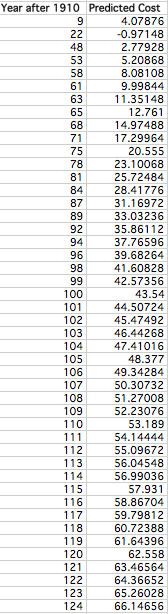

Now we can use our model to predict prices in the

future. Using the cubic equation given by Excel, we get the following data

values up to the year 2034.

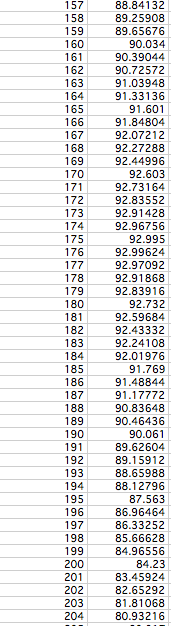

The first column is the number of years after

2010. As seen in the chart, the

equation produced by Excel gives that the next 3 cent increase will be in the

year 2012 (since thatŐs the year it gets over 45 cents). It is predicted that the cost of the

stamp will cost 64 cents in the year 2032. According to my cubic model, the stamp will actually never

reach $1.00 because the maximum value is 93 cents before the price starts to

decrease. But, it is dangerous to extrapolate data that far into the future anyway

since the data reaches 93 cents in the year 2086 and several different things

could change. The data far into

the future is shown in the following chart. The cubic model might not be a good predictor for several

years into the future.